Ad Details

-

Ad ID: 511

-

Added: November 20, 2024

-

Views: 229

Description

===

Losing a loved one is a profoundly emotional experience, often compounded by the logistical challenges that arise in the aftermath. One critical but frequently overlooked task is notifying the Canada Revenue Agency (CRA) of a death. This step is essential for ensuring that the deceased’s tax affairs are settled properly, preventing potential issues for the estate or beneficiaries. Understanding how to navigate this process can alleviate some of the burdens during an already challenging time. In this guide, we will walk you through the importance of notifying the CRA of a death and provide a step-by-step approach for doing it correctly.

Understanding the Importance of Notifying the CRA of a Death

Notifying the CRA of a death is not just a procedural obligation; it holds significant implications for the deceased’s estate and beneficiaries. When a person passes away, their tax obligations do not simply vanish. The CRA needs to be informed to finalize the deceased’s tax matters, ensuring that any outstanding taxes are addressed. Failure to notify the CRA can lead to penalties and interest charges against the estate, which can diminish the assets intended for heirs.

The timeline for notifying the CRA is crucial. Generally, the CRA requires notification within a reasonable period after the death, ideally within 30 days. This timeframe allows the agency to adjust the tax profile of the deceased, ceasing any further tax obligations and initiating the process for final tax returns. Understanding these timelines can help avoid unnecessary complications and delays in settling the estate.

Moreover, notifying the CRA ensures that any potential tax credits or deductions that could benefit the estate or beneficiaries are appropriately applied. For example, the Canada caregiver credit and the basic personal amount can sometimes be retroactively claimed for the year of death, provided the CRA has been informed in a timely manner. Thus, informing the CRA is a strategic move that not only meets legal obligations but also maximizes the financial outcomes for the deceased’s loved ones.

Step-by-Step Instructions for Notifying the CRA Properly

-

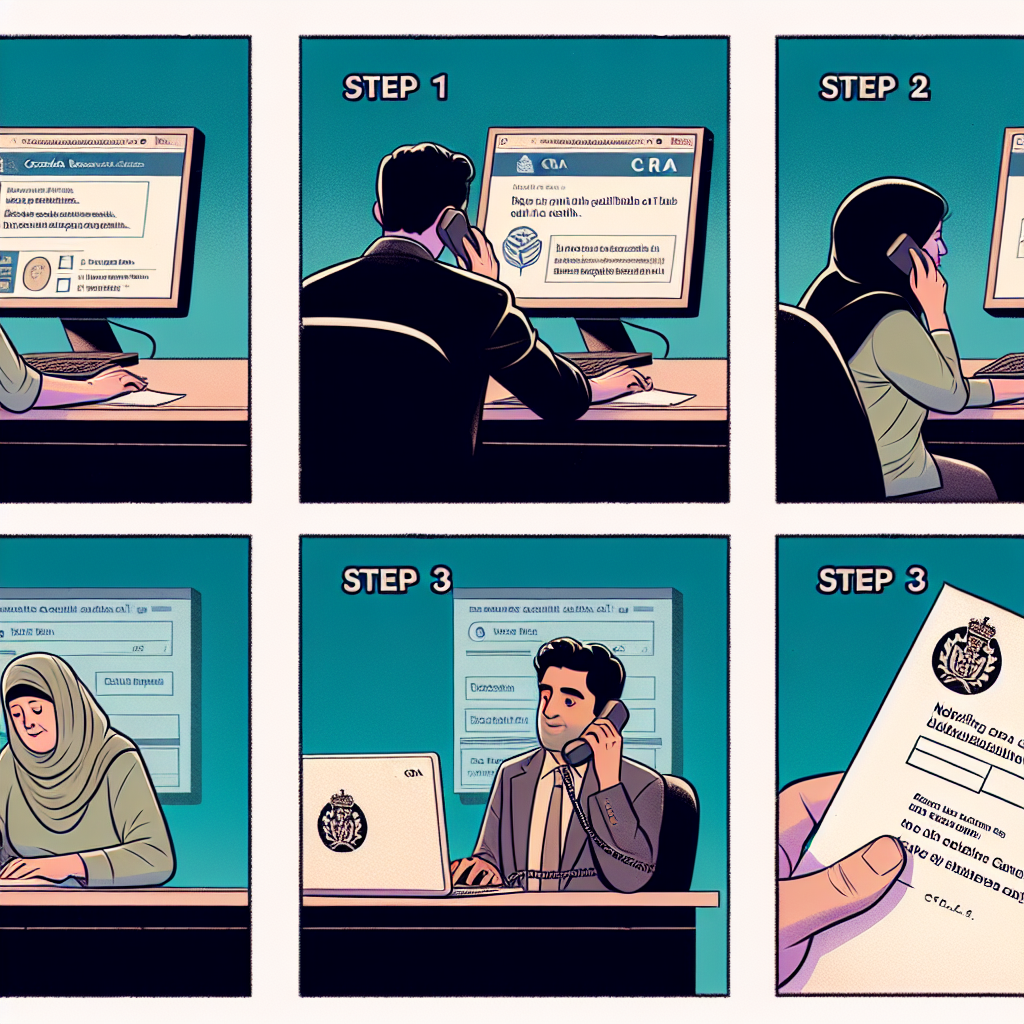

Gather Necessary Documentation: Before contacting the CRA, ensure you have the required documents at hand. This typically includes the deceased’s Social Insurance Number (SIN), their death certificate, and any relevant tax information. Having this documentation organized will streamline the process and reduce frustration.

-

Contact the CRA: You can notify the CRA of a death through several methods, including by mail or phone. For the most efficient service, consider calling the CRA’s individual inquiries line. When speaking to a representative, be prepared to provide the deceased’s personal details, including their name, SIN, and the date of death. This information is pivotal for the CRA to update their records accurately.

-

Complete the Final Tax Return: It is essential to file a final tax return for the deceased, which includes income up to the date of death. This return can be filed by the legal representative of the estate, such as an executor. The CRA provides specific guidelines for completing this return, which must also be submitted along with any necessary supporting documents. Ensure that all income sources are accurately reported to avoid any complications later on.

-

Confirm Notification: After notifying the CRA, it is wise to follow up to confirm that they have updated their records. You can do this by requesting a confirmation letter or by checking the deceased’s account online if you have access. This step helps ensure that there are no outstanding issues with the estate’s tax obligations.

-

Keep Records: Document all communications and transactions with the CRA regarding the death. This includes copies of letters sent, notes from phone calls, and any confirmation received. Having a well-maintained record will be invaluable for reference and could serve as protection against future inquiries.

-

Seek Professional Help If Necessary: If the deceased had complex tax affairs or if you’re uncertain about any steps, it may be beneficial to consult a tax professional. They can provide tailored advice and ensure that all obligations are met efficiently, allowing you to concentrate on the emotional aspects of the transition.

===

Navigating the aftermath of a loved one’s death is undeniably taxing, both emotionally and practically. By understanding the importance of notifying the CRA and following the outlined steps, you can simplify this process and reduce potential complications. Keeping tax matters in order not only honors the memory of the deceased but also protects the financial interests of their estate and beneficiaries. If you’re facing this difficult task, consider these insights as a guide to ensure that you fulfill your obligations with confidence and clarity. Take the necessary steps today so that you can focus on what truly matters—remembering and celebrating the life of your loved one.

Exploring the Rich Tapestry of Christmas FlavoursExperiencing Christmas Eve Traditions in Miller’s PointExploring the Magic of Christmas at the Plaza HotelRelevant LinkRelevant LinkRelevant LinkAlex Formenton: Latest Updates on His NHL JourneyUncovering the Truth: Inside the World of Dirty NewsAishwarya Rai: Latest Updates on Her Career and ProjectsRelevant LinkRelevant LinkRelevant Link